Okay, folks, let’s talk about something that might sound a bit dry at first glance – UPI cross-border payments . But trust me, this is actually pretty revolutionary, especially if you have family abroad, run a business with international clients, or just dream of traveling without drowning in transaction fees. The Reserve Bank of India (RBI) is making moves, and this time, it involves integrating our beloved UPI (Unified Payments Interface) with Europe’s TIPS (TARGET Instant Payment Settlement) system. What does this even mean for you and me? Let’s dive in.

The ‘Why’ | Why This Matters More Than You Think

Here’s the thing: for years, international money transfers have been a pain. We’re talking hefty fees, slow processing times, and complicated procedures. Remittances money sent home by Indians working abroad are a massive part of our economy. According to World Bank data, India is one of the top remittance receiving countries in the world. Any improvement in this area directly impacts millions of families. This RBI initiative aims to drastically cut down on those friction points. It’s not just about convenience; it’s about making a real economic difference. Learn more about the initial announcement here .

What fascinates me is the sheer scale of potential impact. Imagine a small business owner in Jaipur easily paying a supplier in Italy. Or a student in Germany instantly receiving money from their parents back home. This isn’t just about tech; it’s about leveling the playing field and making global commerce more accessible to everyone.

How Will This Integration Actually Work?

Let’s get a bit technical, but I promise to keep it simple. TIPS, managed by the European Central Bank, is a system for instant payments in euro. Integrating UPI with TIPS means that Indian users can potentially make payments in euro directly from their UPI-linked bank accounts. Here’s the (simplified) chain of events:

- You initiate a payment through your UPI app.

- The UPI system communicates with the TIPS system.

- The funds are transferred from your account to the recipient’s account in Europe – almost instantly.

Of course, there are likely to be intermediaries (banks and payment processors) involved behind the scenes, but the goal is to make the process as seamless as possible for the end user. What’s also important is the use of real-time payment systems and the reduction of reliance on traditional SWIFT transfers, which are often slower and more expensive.

Potential Benefits | More Than Just Speed

Beyond the obvious benefits of speed and lower costs, there are other significant advantages to this integration:

- Increased Transparency: With instant payments, you know exactly when the money has been sent and received. No more guessing games or worrying about delays.

- Enhanced Security: Both UPI and TIPS have robust security measures in place, minimizing the risk of fraud.

- Financial Inclusion: This could open up new opportunities for individuals and small businesses to participate in the global economy.

I initially thought this was simply about faster transactions, but then I realized the broader implications. It’s about empowering people and businesses to operate on a global scale, regardless of their size or location. And that’s a pretty big deal.

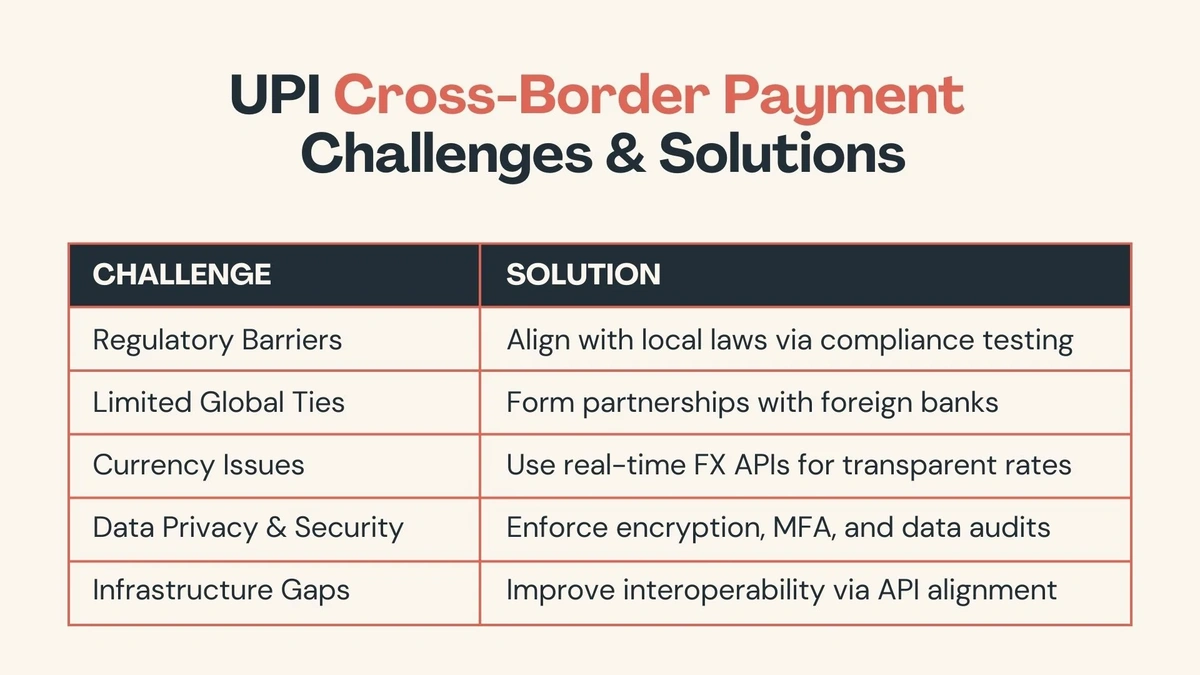

Challenges and the Road Ahead

Now, let’s be honest – it’s not all sunshine and roses. There are challenges to overcome. Regulatory hurdles, technical integration complexities, and ensuring interoperability between different systems are just a few. Also, the actual rollout may take time. It’s unlikely that you’ll be able to use UPI for euro payments tomorrow. But the fact that the RBI is actively working on this is a positive sign. What fascinates me about this integration is its potential to reduce the cost of cross-border transactions and spur economic activity.

One potential hurdle is currency conversion costs. While the direct UPI-TIPS integration eliminates some intermediary fees, the exchange rate between INR and EUR will still play a role. It’s crucial that these conversion rates are competitive and transparent to maximize the benefits for users.

What This Means for the Average Indian

So, how does all of this affect you, the average Indian? Here’s the breakdown:

- If you regularly send money to family or friends in Europe, you could save a significant amount on transaction fees.

- If you run a business with European clients or suppliers, you can make and receive payments more efficiently.

- If you travel to Europe, you might be able to use your UPI app to make payments directly, without having to rely on credit cards or currency exchange.

The potential for ease of transactions and reduced costs are huge. For example, many students studying abroad in Europe could greatly benefit from streamlined and cheaper international fund transfers . And for those working abroad, sending money home becomes simpler and more affordable.

It’s worth keeping an eye on this development. This isn’t just about tech; it’s about making your life easier and more affordable. As per reports, this initiative might further lead to integrating other countries to enable instant payment settlement . Another major fintech innovation is also in the works .

FAQ on UPI and Cross-Border Payments

Frequently Asked Questions

When will this integration be fully implemented?

The exact timeline is not yet clear, but the RBI is actively working on it. Keep an eye on official announcements for updates.

Will this work with all UPI apps?

That’s the goal, but it will likely depend on whether your specific UPI app provider supports the integration.

Are there any limits on the amount of money I can transfer?

Yes, there are usually limits on UPI transactions, and these may vary depending on your bank and the specific regulations in place.

Will this be available for other currencies besides the euro?

Potentially, but the initial focus is on integrating with the euro through the TIPS system.

Is this just for personal transfers, or can businesses use it too?

Both personal and business transfers are expected to be supported.

What if I encounter a problem during the transaction?

You’ll need to contact your UPI app provider or bank for assistance.

Disclaimer: ऊपर दिए गए विचार और सिफारिशें व्यक्तिगत विश्लेषकों या ब्रोकिंग कंपनियों की हैं, न कि "Finance Ghar" की। हम निवेशकों को सलाह देते हैं कि किसी भी निवेश निर्णय लेने से पहले प्रमाणित विशेषज्ञों से परामर्श करें। निवेश में जोखिम होता है और सही जानकारी के बिना निर्णय लेना हानिकारक हो सकता है।