Okay, folks, let’s talk about what happened with the Sensex today. A 331-point drop – it sounds dramatic, right? But here’s the thing: headlines often paint a scarier picture than reality. What truly matters is understanding why this happened and what it means for you, the average Indian investor. Forget the noise; let’s dive into the real story behind the market dip. We will also discuss the impact of Foreign Institutional Investors (FII) outflows on Indian stock market.

Profit-Taking | The Market’s Natural Breath

The primary culprit behind today’s downturn? Good old profit-taking. After a decent run-up, investors decided to cash in some of their gains. Think of it like this: you’ve been patiently waiting for your mango tree to bear fruit, and when it finally does, you harvest some to enjoy and sell. That’s essentially what’s happening in the market. It’s a very natural phenomenon. What fascinates me is how predictable (and yet unpredictable) this can be. No one can truly time the market perfectly, right ?

But here’s where it gets interesting. This profit-booking wasn’t just a random event. It was amplified by concerns about Foreign Institutional Investors (FIIs) pulling out their money. Now, why would they do that? Well, several factors could be at play. Rising interest rates in the US might be tempting them to invest back home. Or perhaps they see better opportunities in other emerging markets. A key factor is the change in global market trends . Whatever the reason, when FIIs sell, it creates downward pressure on the market.

And, the Nifty closing under 26,000 – that’s a psychologically important level. It can trigger further selling as traders who use technical analysis see it as a bearish signal. It’s important to understand that market psychology plays a huge role. Fear and greed are powerful motivators. This article might help you understand the market movements.

The FII Factor | Understanding the Outflow

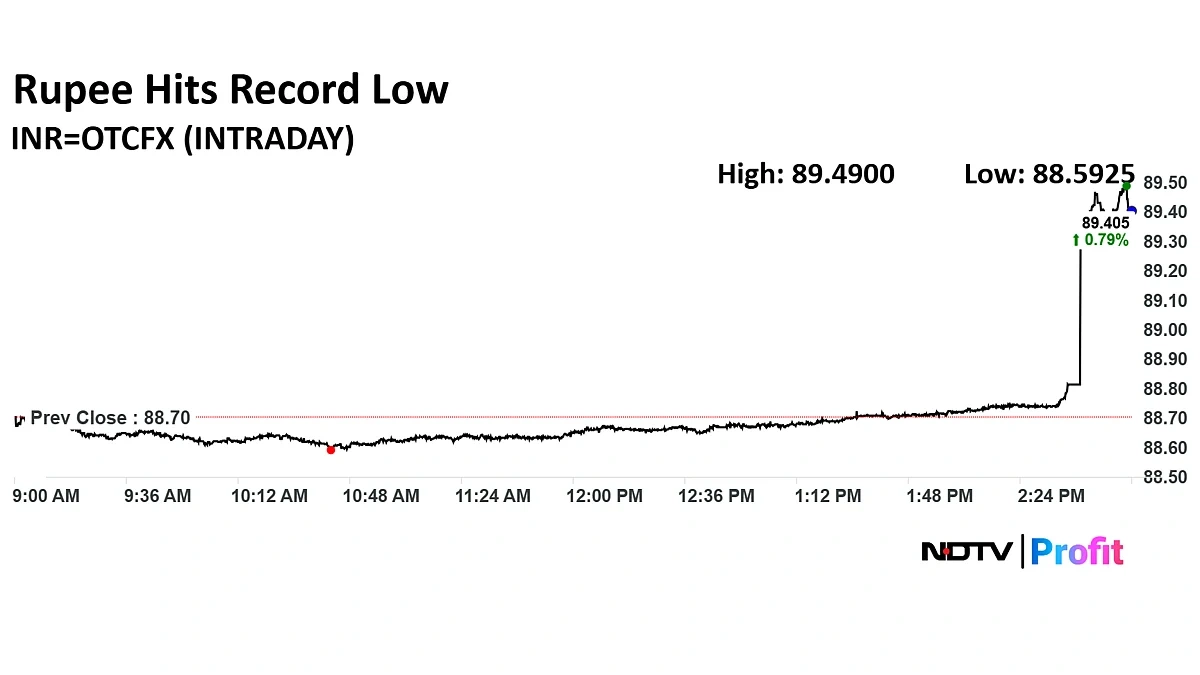

Let’s dig a little deeper into these FII outflows. These folks manage huge sums of money, and their actions can have a significant impact on the Indian stock market. A common mistake I see people make is underestimating their influence. When they sell Indian stocks and convert the rupees back into their home currency (usually US dollars), it weakens the rupee and can lead to imported inflation. Now, that’s something we all feel in our wallets, isn’t it?

Moreover, consistent FII selling can dampen overall market sentiment. It creates a feeling of uncertainty and can discourage domestic investors from buying. It’s like a self-fulfilling prophecy – the more they sell, the more others get worried and sell too.

According to data from the National Stock Exchange ( NSE ), FIIs have been net sellers for several consecutive sessions. This trend is something to watch closely. However, it’s also crucial to remember that FII flows are cyclical. They come and go. The important thing is to not panic and make rash decisions based on short-term movements. A related keyword is market correction which means a short-term drop is common and normal in a growing market.

What Does This Mean for You?

Okay, so the market sentiment dipped, FIIs are selling, and Nifty is below 26,000. But what does it all mean for your investments? Should you sell everything and hide under a rock? Absolutely not! This is where a long-term perspective is crucial.

Think of this as a buying opportunity. When the market dips, fundamentally sound stocks become available at lower prices. It’s like a sale at your favorite store. But – and this is a big but – do your research first. Don’t just buy anything that’s cheap. Look for companies with strong financials, good management, and a proven track record. Invest in fundamentally strong blue-chip stocks .

Also, remember the power of diversification. Don’t put all your eggs in one basket. Spread your investments across different sectors and asset classes. This will help you weather the ups and downs of the market. You should also be aware about geopolitical risks which affect market.

Long-Term Perspective is Key

Let me rephrase that for clarity. The Indian economy is still growing, despite short-term hiccups. We have a large and growing middle class, increasing consumption, and a government focused on infrastructure development. These are all positive long-term factors that will support the stock market. So, don’t let short-term volatility derail your long-term investment goals. Read more about long-term invesments.

The one thing you absolutely must do is stay informed. Keep track of market news, economic data, and company announcements. But don’t get overwhelmed by the information overload. Focus on the signals that matter most to your investments.

Is it Time to Rebalance Your Portfolio?

This market dip might also be a good time to rebalance your portfolio. Rebalancing means adjusting your asset allocation to bring it back in line with your original investment plan. For example, if your equity allocation has increased due to market gains, you might want to sell some equity and buy more debt to maintain your desired asset allocation.

Rebalancing helps you manage risk and stay disciplined with your investments. And, let’s be honest, it’s a good way to take some profits off the table and lock in your gains. Consider taking advice from a financial advisor to get right strategy.

FAQ Section

Frequently Asked Questions

Should I panic and sell all my stocks?

No, absolutely not! Market dips are normal. Panicking and selling is usually the worst thing you can do.

Is this a good time to invest more?

It could be. Do your research and look for fundamentally strong stocks that are now available at lower prices.

What is the impact of FII outflows on the rupee?

FII outflows can weaken the rupee, leading to imported inflation.

How often should I rebalance my portfolio?

Typically, once a year is a good starting point, but it depends on your individual circumstances.

What if I don’t understand all this technical jargon?

That’s okay! Focus on the big picture. Understand the basic principles of investing, and don’t be afraid to seek help from a financial advisor.

Are small-cap stocks a good buy right now?

Small-cap stocks can be more volatile. If you’re comfortable with the risk, they could offer higher returns, but do your homework!

So, there you have it. The Sensex dipped, Nifty stumbled, but it’s not the end of the world. Stay calm, stay informed, and remember that investing is a marathon, not a sprint. And who knows, this little dip might just be the opportunity you’ve been waiting for. Think long-term, invest wisely, and you’ll be just fine. I hope this information on stock market updates helps you.

Disclaimer: ऊपर दिए गए विचार और सिफारिशें व्यक्तिगत विश्लेषकों या ब्रोकिंग कंपनियों की हैं, न कि "Finance Ghar" की। हम निवेशकों को सलाह देते हैं कि किसी भी निवेश निर्णय लेने से पहले प्रमाणित विशेषज्ञों से परामर्श करें। निवेश में जोखिम होता है और सही जानकारी के बिना निर्णय लेना हानिकारक हो सकता है।