Okay, let’s be real. When you hear about some big investment firm like Jefferies throwing around predictions about India’s FY27 profit growth, it’s easy to glaze over. Numbers, sectors, growth rates… it can all sound like noise. But here’s the thing: this isn’t just about abstract figures. It’s about where your money could be going, where jobs are likely to be created, and what the future of India might actually look like. So, instead of just regurgitating Jefferies’ report, let’s dive deep and see what’s really cooking. What fascinates me is not just the sectors they picked, but the underlying trends driving their choices . Let’s get into it.

The ‘Why’ Behind Jefferies’ Optimism | Decoding the Signals

Why should we even care what Jefferies thinks? Well, they’re not just pulling numbers out of thin air. They’re analyzing market trends, government policies, and global economic shifts. Their optimism stems from a few key factors. India’s growing consumer base, increasing urbanization, and government’s focus on infrastructure development is important. These elements create a fertile ground for specific sectors to flourish. And frankly, understanding these factors helps us, as everyday citizens and investors, make smarter choices. It’s not just about blindly following recommendations; it’s about understanding the ‘why’ behind them. Think of it as learning to read the tea leaves of the Indian economy. By understanding the macroeconomic factors and government initiatives involved, it offers a clearer picture of the investment landscape. A common mistake I see people make is taking reports like these at face value without considering the broader economic context.

But, there is more. India’s technological advancement and the push for digital infrastructure is another key element of the profit growth.

Sector Spotlight | Decoding the 4 Hotspots

So, what sectors are Jefferies highlighting? While I won’t spill all the beans right away (gotta keep you reading!), let’s say they’re focusing on areas tied to India’s rising consumerism, infrastructure boom, and digital revolution. Expect to hear about industries benefiting from increased spending power, government investment in roads and railways, and the proliferation of smartphones and internet access. Here’s the thing – it’s not enough to know the sectors. It’s crucial to understand why they’re promising. Is it a cyclical trend? A long-term shift? Or is it heavily reliant on specific government policies that could change? It’s about digging deeper than the surface-level hype. Let’s consider for example the growth of renewable energy . India’s commitment to reducing carbon emissions is not just a political statement, it’s creating a massive market for solar, wind, and other clean energy technologies. Companies investing in these areas are likely to see significant growth in the coming years, as they are also focused on sustainable development .

India’s Burgeoning Middle Class | The Engine of Growth

Let’s be honest, India’s story is largely a consumer story. The rise of the middle class, with its increasing disposable income and aspirational lifestyles, is fueling demand across various sectors. From consumer goods and automobiles to financial services and healthcare, the Indian consumer is becoming a major driver of economic growth. What fascinates me is the changing consumption patterns – the shift towards premium products, the increasing adoption of online shopping, and the growing demand for experiences. Understanding these shifts is key to identifying the most promising investment opportunities. And here’s where the ‘Emotional’ angle comes in: it’s not just about numbers; it’s about understanding the aspirations, the dreams, and the anxieties of the Indian consumer. What is the consumer spending like currently? The latest retail sales data indicate a robust consumer spending scenario, with both urban and rural markets displaying strong growth. This spending is greatly impacted by disposable income .

According to the latest data from theNational Statistical Office (NSO), the per capita disposable income in India has seen a steady increase over the past few years, contributing to higher consumer expenditure across various sectors.

Risks and Caveats | A Dose of Reality

Now, before you go all-in on these sectors, let’s inject a dose of reality. No investment is risk-free, and India has its own set of challenges. Infrastructure bottlenecks, regulatory hurdles, and global economic volatility are all factors that could impact growth. Let me rephrase that for clarity: it’s crucial to do your own research, understand the risks involved, and diversify your portfolio. A common mistake I see people make is chasing short-term gains without considering the long-term implications. It’s like betting on a horse race without knowing anything about the horse, the jockey, or the track. Also, it’s important to watch out for market volatility and its impacts. And remember, economic forecasts are just that – forecasts. They’re based on assumptions, and those assumptions can change. What I initially thought was a straightforward prediction turned out to be a complex interplay of various factors. Always be prepared for the unexpected.

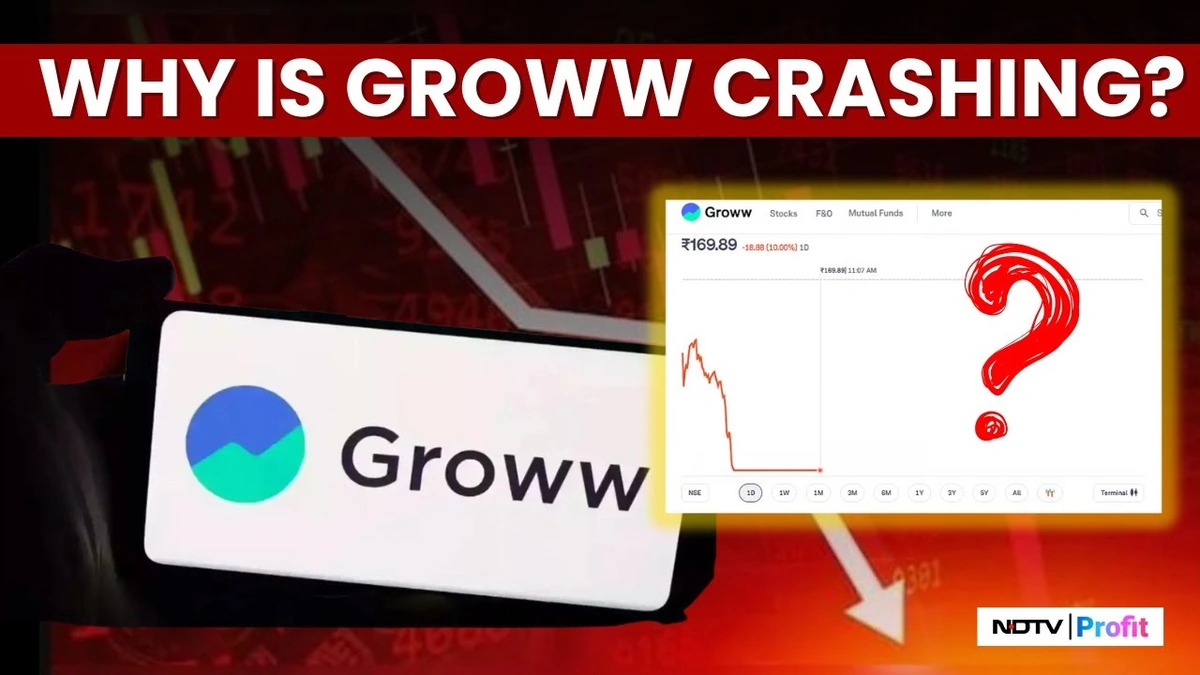

Here’s the thing. To get a better grasp on your finances, consider reading about Groww share price .

Final Thoughts | India’s FY27 Profit – A Story of Potential

So, what’s the bottom line? Jefferies’ report highlights the potential for significant profit growth in India, driven by specific sectors benefiting from the country’s unique economic dynamics. But it’s not a guaranteed slam dunk. It requires careful analysis, a deep understanding of the risks, and a long-term perspective. Think of it as planting a seed – you need to nurture it, protect it from pests, and be patient to see it grow. But if you do it right, the rewards can be substantial. But, remember the analysis of financial experts and investment strategies is crucial.

FAQ Section

What are the key factors driving India’s FY27 profit growth?

India’s rising consumer base, urbanization, infrastructure development, and digital revolution are key drivers.

Which sectors are expected to perform well?

Sectors tied to consumerism, infrastructure, and digital technologies are expected to thrive.

What are the risks associated with investing in these sectors?

Infrastructure bottlenecks, regulatory hurdles, and global economic volatility pose risks.

How can I make informed investment decisions?

Do your research, understand the risks, and diversify your investment portfolio.

Is it safe to blindly follow Jefferies’ recommendations?

No, always do your own research and consider your individual investment goals.

What role does consumer spending play in India’s profit growth?

Increasing disposable income and aspirational lifestyles fuel demand across sectors.

Disclaimer: ऊपर दिए गए विचार और सिफारिशें व्यक्तिगत विश्लेषकों या ब्रोकिंग कंपनियों की हैं, न कि "Finance Ghar" की। हम निवेशकों को सलाह देते हैं कि किसी भी निवेश निर्णय लेने से पहले प्रमाणित विशेषज्ञों से परामर्श करें। निवेश में जोखिम होता है और सही जानकारी के बिना निर्णय लेना हानिकारक हो सकता है।