The Indian stock market is on a roll! The Sensex and Nifty have not only touched record highs but are also enjoying a third consecutive week of gains. But here’s the thing: it’s not just about the numbers flashing green. It’s about why this is happening and, more importantly, what it means for you – the investor, the aspirational investor, and even the average person keeping an eye on the economy. Let’s dive deep into this stock market rally .

Decoding the Bull Run | What’s Fueling the Fire?

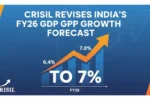

So, what’s behind this surge? I initially thought it was just one or two factors, but then I realized it’s a confluence of several things working together. First, there’s the robust performance of the Indian economy. GDP growth has been encouraging, and various sectors are showing signs of strong recovery. Then there’s the increased participation of retail investors – that’s you and me! More and more people are putting their money into the stock market , driving up demand. Don’t underestimate the power of collective optimism!

Foreign Institutional Investors (FIIs) are also playing a crucial role. After a period of selling, they’ve turned into net buyers, injecting significant capital into the market. Furthermore, global cues are positive; a stable international economic environment always helps. Low global interest rates encourage investment in emerging markets like India. Of course, the strength of the Indian Rupee against the dollar always helps as well.

Sectoral Showdown | Which Industries Are Leading the Charge?

It’s not a uniform rally across all sectors. Some industries are shining brighter than others. Financial services, particularly banks and NBFCs, are major contributors, benefiting from increased lending and improved asset quality. The IT sector continues its steady growth, driven by global demand for digital services. Auto companies are also doing well, reflecting a recovery in consumer demand. Infrastructure stocks are also seeing green as the government ramps up spending on projects. Let’s be honest, a good monsoon season and strong agricultural output always boost sentiment too, indirectly benefiting many sectors.

However, a few sectors are lagging behind. For example, while the broader market surges, some pockets of the Indian stock market are still facing headwinds. It’s crucial to do your homework and not just blindly follow the rally. Understanding sector-specific dynamics is key for informed investment decisions.

The Ripple Effect | How the Rally Impacts Your Wallet

This stock market surge isn’t just a headline; it directly affects your financial well-being. If you’re an investor, your portfolio is likely seeing gains (woohoo!). Even if you’re not directly invested, a strong stock market reflects a healthy economy, which can lead to job creation, higher incomes, and increased consumer confidence. It’s a virtuous cycle, hopefully!

But, and this is a big but, a rising market also brings risks. Valuations become stretched, and the potential for correction increases. This is where the expertise comes in. It’s crucial to stay disciplined, avoid FOMO (fear of missing out), and invest based on sound financial planning, not just market hype. Consider talking to a financial advisor to assess your risk tolerance and investment goals. A common mistake I see people make is chasing short-term gains without considering the long-term implications. It’s like planting a tree and expecting it to bear fruit overnight – patience is key!

Here’s moreon potential global impacts, and remember, timing the market is notoriously difficult, so focus on time in the market. Plus, remember to factor in equity investments , as well as the global market and associated economic indicators when setting up your investment strategy.

Navigating the High Seas | Strategies for Investors

So, how should you navigate this market rally? Here’s some real talk: now is the time to review your portfolio. Are you properly diversified? Are your investments aligned with your risk tolerance and financial goals? It’s also a good time to book some profits. Selling a portion of your holdings allows you to lock in gains and reduce your overall risk. Rebalancing your portfolio ensures that your asset allocation remains consistent with your investment strategy. Don’t put all your eggs in one basket – that’s a recipe for disaster! Consider spreading your investments across different asset classes, such as stocks, bonds, and real estate.

And remember, a bull market doesn’t last forever. Market corrections are inevitable, and it’s important to be prepared. Keep some cash on the sidelines so you can take advantage of opportunities when the market dips. Invest gradually rather than all at once – this is known as dollar-cost averaging. Do some research on various financial instruments to help you diversify.

I initially thought this was straightforward, but then I realized the importance of due diligence. Avoid penny stocks. Many companies have shown real economic growth . As per the guidelines of SEBI, thoroughly research any company before investing. Don’t fall for get-rich-quick schemes. Invest in businesses you understand and that have a proven track record. If it sounds too good to be true, it probably is!

Here’s something elseto consider: keep a long-term perspective. The stock market is a marathon, not a sprint. Focus on building a solid portfolio that will grow over time, regardless of short-term market fluctuations.

Plus, it’s not just about investing in established companies. There are opportunities to invest in emerging companies and new sectors. This includes alternative investments , which can add another layer of diversification to your portfolio. As the market continues its upward trajectory, the allure of IPOs (Initial Public Offerings) grows stronger. But proceed with caution. Investing in IPOs can be highly risky, as there’s limited historical data to assess their performance.

The Road Ahead | What to Expect and How to Prepare

Looking ahead, the future of the stock market remains uncertain. While the current rally is encouraging, there are several factors that could impact its trajectory. Global economic conditions, geopolitical events, and changes in government policies can all influence market sentiment. It’s crucial to stay informed and adapt your investment strategy accordingly. But don’t let fear or greed drive your decisions.

Consider consulting a financial advisor to help you navigate the complexities of the market. A good advisor can provide personalized guidance based on your individual circumstances. And the one thing you absolutely must double-check on is your risk management strategy. Implement stop-loss orders to limit your potential losses. Diversify your portfolio across different asset classes to reduce your overall risk. And, critically, avoid overleveraging.

As for the Indian stock market, I believe its long-term prospects remain bright. India is a growing economy with a large and young population. The country is also making significant strides in areas such as infrastructure, technology, and manufacturing. These factors, coupled with a stable political environment, should continue to attract both domestic and foreign investment.

While sources suggest that this trend may continue, the official confirmation is still pending. It’s best to keep checking the official portal.

FAQ

Is it too late to invest in this rally?

Not necessarily. But be selective. Focus on quality stocks and invest gradually.

What sectors should I be looking at?

Financial services, IT, auto, and infrastructure are showing promise.

How can I protect my portfolio from a market correction?

Diversify, rebalance, and keep some cash on the sidelines.

Should I invest in IPOs right now?

Proceed with caution. IPOs can be risky, so do your research.

What role do foreign investments play?

Foreign Institutional Investors (FIIs) greatly influence the market.

What if I’m new to the stock market?

Start small, educate yourself, and consider talking to a financial advisor.

Ultimately, a successful investment strategy requires a blend of knowledge, discipline, and patience. The stock market rally presents both opportunities and risks. By understanding the underlying factors, staying informed, and making sound financial decisions, you can position yourself to benefit from the market’s growth while protecting your capital. What fascinates me is the resilience of the Indian market, but remember to invest wisely. Remember that the bond market can sometimes be more steady than the equity market , depending on prevailing interest rates .

Disclaimer: ऊपर दिए गए विचार और सिफारिशें व्यक्तिगत विश्लेषकों या ब्रोकिंग कंपनियों की हैं, न कि "Finance Ghar" की। हम निवेशकों को सलाह देते हैं कि किसी भी निवेश निर्णय लेने से पहले प्रमाणित विशेषज्ञों से परामर्श करें। निवेश में जोखिम होता है और सही जानकारी के बिना निर्णय लेना हानिकारक हो सकता है।