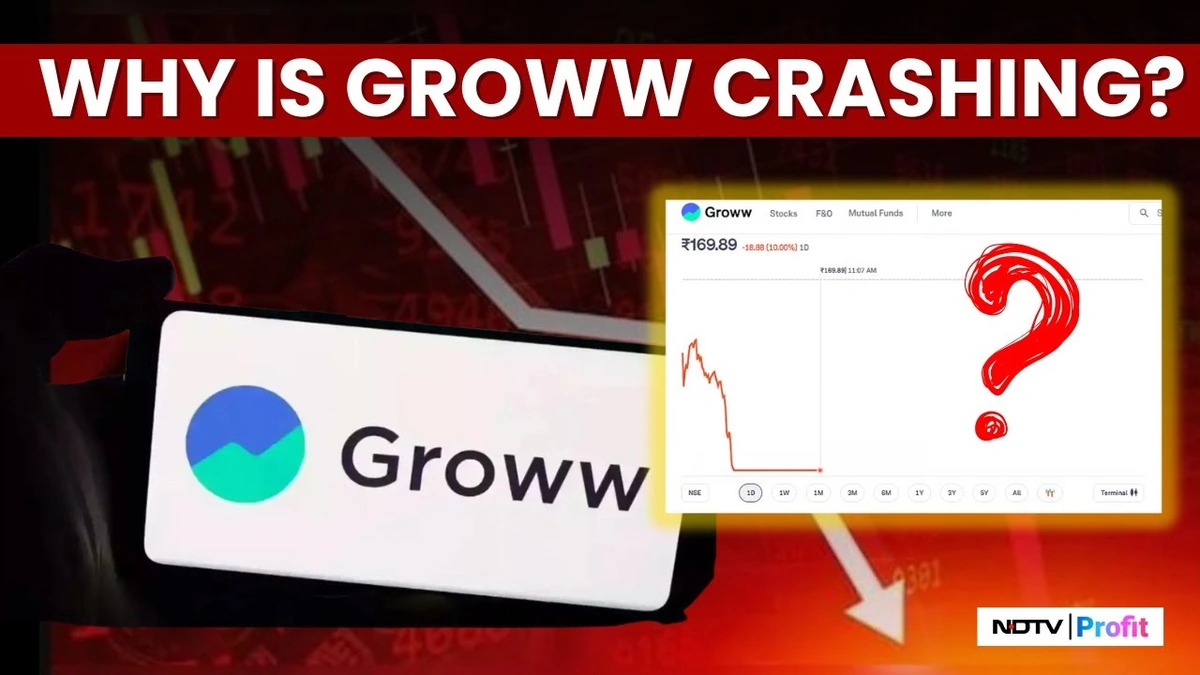

So, Groww’s Q2 earnings report is out, and the stock took a bit of a dip after an initial surge. What’s the deal? It’s easy to get caught up in the daily ups and downs of the market, but let’s be honest, there’s more to the story than just a closing price. We need to dig deeper and understand why this happened and, more importantly, what it means for you as an investor. Is this a temporary blip, or is it a sign of something bigger?

Understanding the Initial Surge

First things first, let’s talk about that initial surge. Typically, a stock price jumps when a company announces positive news or exceeds expectations. Maybe the Groww revenue numbers were higher than analysts predicted, or perhaps there was some exciting news about a new product launch. Investors get excited, they buy the stock, and the price goes up. Simple, right? But here’s the thing: the market is a complex beast, and initial reactions aren’t always the full picture.

The surge could also be due to speculative trading, hype generated by news articles, or even just a broader market rally that lifts all boats. It’s crucial to understand the underlying reason for the surge before drawing any conclusions. Let’s be clear, you need to consider the market capitalization of Groww before over reacting to an initial surge.

Why the Drop? The Analyst’s Perspective

Okay, so the stock went up, then it went down. Why? This is where the analysis gets interesting. Several factors could contribute to a post-earnings drop, even after a positive initial reaction:

- Profit-Taking: This is the most common reason. Traders who bought the stock before the earnings announcement might sell their shares to lock in profits after the initial surge. It’s a classic “buy the rumor, sell the news” scenario.

- Reality Check: Sometimes, the initial enthusiasm fades when investors start digging into the details of the earnings report. Maybe the profit margins weren’t as high as expected, or perhaps the company’s guidance for the next quarter was a bit underwhelming.

- Broader Market Conditions: The overall market sentiment can also play a role. If the market is experiencing a downturn, even a good earnings report might not be enough to prevent a stock from falling.

And here’s a crucial point for us in India: regulatory changes and government policies can heavily influence market sentiment. So, the next time you see a stock dip after earnings, remember to look beyond the surface numbers. Understand what market sentiment is at that given time.

What This Means for You | The Investor’s Guide

So, you’re an investor, and you’re wondering what to do with this information. Here’s the practical advice: don’t panic. One day’s stock performance rarely tells the whole story. Instead, take a step back and consider the following:

- Long-Term Outlook: What’s your investment horizon? If you’re a long-term investor, a short-term dip shouldn’t be a major concern. Focus on the company’s fundamentals, its growth potential, and its competitive advantage.

- Risk Tolerance: Are you comfortable with volatility? If you’re a risk-averse investor, you might want to consider reducing your position in the stock. But if you’re willing to ride out the ups and downs, you might see this dip as a buying opportunity. A common mistake I see people make is over reacting when stock valuation changes.

- Diversification: Never put all your eggs in one basket. Make sure you’re diversified across different asset classes and sectors. This will help you mitigate risk and protect your portfolio from market volatility.

Let’s be honest, investing is a marathon, not a sprint. Don’t get caught up in the daily noise. Stay focused on your long-term goals, and make informed decisions based on your individual circumstances.

The Importance of Context | Beyond the Numbers

What fascinates me is how much context matters. A single earnings report is just one piece of the puzzle. To truly understand a company’s performance, you need to consider the broader economic environment, the competitive landscape, and the company’s strategic initiatives.

For example, if financial analysis shows the company is investing heavily in research and development, that might explain lower profits in the short term. But it could also signal significant growth potential in the future. Similarly, if the company is facing increased competition, that could put pressure on its margins, leading to a lower stock price.

As per the guidelines mentioned in various investing books, learn to read between the lines. Don’t just focus on the numbers; understand the story behind the numbers.

One thing you absolutely must double-check is the source of your data. Are you relying on reputable financial news outlets? Are you verifying information from multiple sources? Don’t blindly trust everything you read online; do your own due diligence.

Groww’s Future | What’s Next?

So, what does the future hold for Groww? Well, that’s the million-dollar question, isn’t it? The answer depends on a variety of factors, including the company’s ability to execute its strategic plans, the overall health of the Indian economy, and the regulatory environment. And of course, changes in the market recovery factors .

However, in my opinion, Groww’s got a pretty solid foundation. They’ve built a strong brand, they have a loyal customer base, and they’re operating in a high-growth industry. So, while the stock price might experience some short-term volatility, I’m optimistic about their long-term prospects.

The key is to stay informed, stay disciplined, and stay focused on your long-term goals. Don’t let short-term market fluctuations derail your investment strategy. It’s not about timing the market; it’s about time in the market.

Investing is a journey. Here’s a helpful investing dictionary to keep up with the investing lingo!

FAQ Section

What if I’m new to investing? Is Groww still a good option?

If you’re just starting out, Groww can be a user-friendly platform to begin your investment journey. However, always do your research and understand the risks involved before investing in any stock. Consider starting with smaller amounts and gradually increasing your investment as you become more comfortable.

How often should I check my Groww portfolio?

It depends on your investment style. Long-term investors might only check their portfolio once a month or even quarterly. Active traders, on the other hand, might check it daily. However, avoid obsessively checking your portfolio, as this can lead to emotional decision-making.

What are some alternatives to Groww for investing in the Indian stock market?

There are several other popular platforms in India, including Zerodha, Upstox, and Angel One. Each platform has its own pros and cons, so it’s worth comparing them to see which one best suits your needs.

Is it safe to keep my money in a Groww account?

Groww is a SEBI-registered broker, which means it’s subject to regulatory oversight. However, like any financial institution, there’s always some level of risk involved. Make sure you understand the platform’s security measures and take steps to protect your account, such as using a strong password and enabling two-factor authentication. The one thing you absolutely must double-check on your account is your registered contact information.

And remember to take note of trading volume and stock price volatility .

Ultimately, investing is a personal journey, and there’s no one-size-fits-all answer. The key is to stay informed, stay disciplined, and stay true to your own investment goals.

Remember to check other trending finance news!

Disclaimer: ऊपर दिए गए विचार और सिफारिशें व्यक्तिगत विश्लेषकों या ब्रोकिंग कंपनियों की हैं, न कि "Finance Ghar" की। हम निवेशकों को सलाह देते हैं कि किसी भी निवेश निर्णय लेने से पहले प्रमाणित विशेषज्ञों से परामर्श करें। निवेश में जोखिम होता है और सही जानकारी के बिना निर्णय लेना हानिकारक हो सकता है।