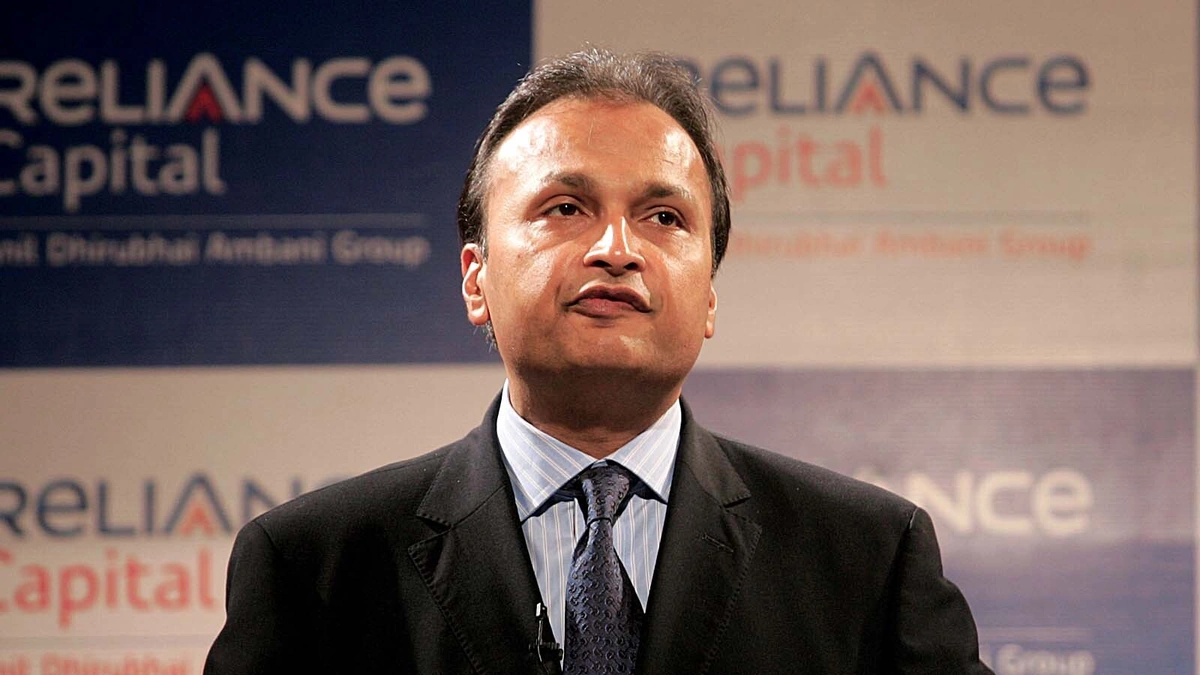

Alright, let’s dive into this Anil Ambani situation, shall we? The Enforcement Directorate (ED) seizing a whopping ₹3,084 crore in assets linked to him is no small potatoes. It’s not just about the numbers; it’s about what this signifies for Indian business, regulatory oversight, and the ongoing battle against money laundering . Here’s the thing – this isn’t just a news headline; it’s a complex story unfolding, and we’re here to unpack it. What fascinates me is how this action by the Enforcement Directorate sends ripples through the entire corporate landscape.

Why This Matters | More Than Just Big Numbers

So, the ED seized assets. Big deal, right? Wrong. This isn’t just about one individual or one company. It’s a reflection of the tightening grip of regulatory bodies on financial irregularities. The “why” behind this action goes deeper than just pointing fingers at wrongdoing. It speaks to the government’s increased focus on transparency and accountability in financial dealings. Think of it as a loud message: no one is too big to be held accountable. This, in turn, can impact investor confidence, corporate governance standards, and the overall economic climate. The move by India’s Enforcement Directorate to seize assets underscores a serious intent to combat economic offenses.

Moreover, this seizure can have cascading effects. Banks that have extended loans to entities linked to Anil Ambani will be under increased scrutiny. Financial institutions will likely reassess their risk exposure and lending practices. It might even lead to a more cautious approach towards corporate lending, especially in sectors perceived as high-risk. This action by the ED isn’t just a legal procedure; it’s a potential catalyst for broader economic adjustments.

Decoding the Money Laundering Probe

Let’s be honest, the term “money laundering” gets thrown around a lot. But what does it really mean in this context? Essentially, it involves concealing the origins of illegally obtained money, making it appear legitimate. In this case, the ED suspects that the assets seized are proceeds of illegal activities, cleverly disguised to avoid detection. This often involves a complex web of transactions, shell companies, and offshore accounts. Unraveling this web requires painstaking investigation and forensic accounting.

I initially thought this was straightforward, but then I realized the sheer complexity of these financial networks. It’s not just about tracing money from point A to point B; it’s about understanding the intent behind each transaction and the relationships between various entities involved. It’s like piecing together a giant jigsaw puzzle where many pieces are missing. The implications of Anil Ambani’s alleged financial irregularities are far-reaching, touching upon investor trust and corporate ethics.

The “How” | A Step-by-Step Look at Asset Seizure

Okay, so the ED seizes assets. But how does this actually work? It’s not like they just show up with a truck and load everything up. It’s a meticulously planned and legally sanctioned process. Here’s a simplified breakdown:

- Investigation: The ED conducts a thorough investigation based on credible information or suspicion of money laundering.

- Provisional Attachment: If the ED has reason to believe that assets are proceeds of crime, it can issue a provisional attachment order, freezing those assets.

- Adjudication: The attachment order is then reviewed by an adjudicating authority, which determines whether the assets are indeed linked to money laundering.

- Confirmation: If the adjudicating authority confirms the link, the attachment becomes final.

- Confiscation: Finally, the assets can be confiscated by the government.

A common mistake I see people make is thinking this is a quick process. In reality, it can take months, even years, to complete the entire cycle. There are legal challenges, appeals, and often, a lot of back-and-forth. It’s a marathon, not a sprint. Understanding the intricacies of asset seizure processes is crucial for comprehending the full impact of the ED’s actions.

The Emotional Angle | What Does This Mean for the Average Investor?

That moment of anxiety when you see headlines like this – we’ve all been there. You wonder, “Is my money safe? Are my investments at risk?” It’s a natural reaction. Let’s be honest, news of financial irregularities can shake investor confidence, especially in a market where trust is paramount. The key is to stay informed, diversify your investments, and not panic. Remember, knee-jerk reactions often lead to poor decisions.

The impact of such events on the stock market is often immediate, with shares of related companies taking a hit. However, the long-term effects are more nuanced. It can lead to greater scrutiny of corporate governance practices and a demand for increased transparency. For the average investor, this means being more vigilant about where you put your money and understanding the risks involved. It also highlights the importance of regulatory bodies like the ED in safeguarding investor interests. Consider the implications for shareholders of companies linked to Anil Ambani, who may experience market volatility following the asset seizure.

Read about other dividend stocks .

Anil Ambani’s Current Financial Situation

The seizure of assets by the ED adds another layer to Anil Ambani’s already complex financial situation. Over the past few years, his business empire has faced significant challenges, with mounting debt and declining fortunes. This latest development is likely to exacerbate those challenges, making it even more difficult to turn things around. This situation highlights the volatile nature of business and the importance of sound financial management.

The seizure of assets is a critical event, especially given Ambani’s past business dealings. This situation brings attention to Anil Ambani’s debts and the broader implications for his remaining assets and business ventures.

But, here’s the thing: resilience is a key trait in the business world. Whether Anil Ambani can navigate through these turbulent times remains to be seen. However, this episode serves as a cautionary tale for businesses everywhere – a reminder that even the most powerful empires can crumble under the weight of financial mismanagement.

More insights on investment strategies can be found here .

FAQ Section

What exactly does ‘asset seizure’ mean?

It means the Enforcement Directorate has taken control of properties and funds believed to be linked to illegal activities, preventing Anil Ambani from selling or using them.

What happens to the seized assets now?

The assets will be held by the ED while the money laundering case proceeds. If Ambani is found guilty, the assets could be permanently confiscated by the government.

Is Anil Ambani arrested?

As of the latest reports, Anil Ambani has not been arrested in connection with this particular case. The investigation is ongoing.

How does this affect Reliance Group?

While the seized assets are linked to Anil Ambani personally, the news can still indirectly affect investor sentiment towards other Reliance Group companies.

What are the implications of this case for other Indian businesses?

This case sends a strong message about increased scrutiny of financial dealings and the government’s commitment to combating money laundering.

In conclusion, the ED’s seizure of ₹3,084 crore in Anil Ambani-linked assets is more than just a financial headline. It’s a complex narrative involving regulatory oversight, corporate governance, and the ongoing fight against financial crime. It serves as a reminder that in the world of business, transparency, accountability, and ethical practices are not just buzzwords; they’re the cornerstones of long-term sustainability. The scrutiny surrounding Anil Ambani’s finances continues to intensify, underscoring the need for stricter financial regulation and corporate transparency.

Disclaimer: ऊपर दिए गए विचार और सिफारिशें व्यक्तिगत विश्लेषकों या ब्रोकिंग कंपनियों की हैं, न कि "Finance Ghar" की। हम निवेशकों को सलाह देते हैं कि किसी भी निवेश निर्णय लेने से पहले प्रमाणित विशेषज्ञों से परामर्श करें। निवेश में जोखिम होता है और सही जानकारी के बिना निर्णय लेना हानिकारक हो सकता है।